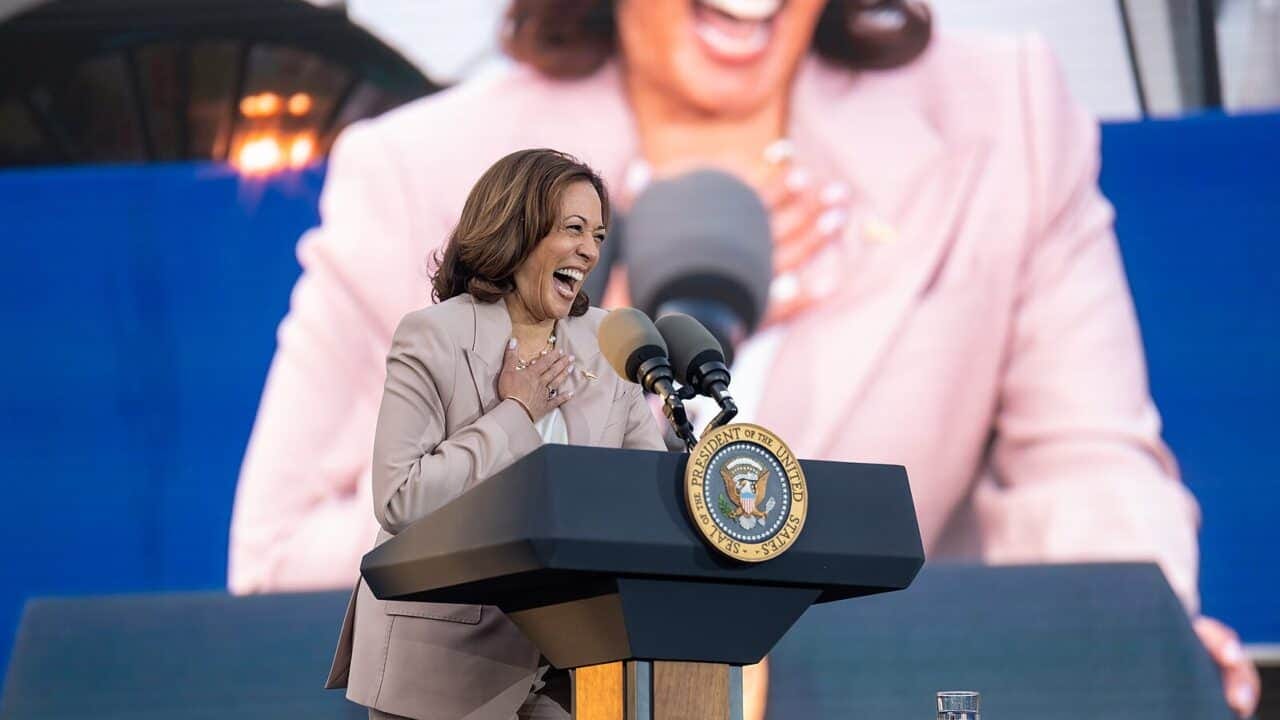

The Kamala Harris plan to tax 'unrealized gains' would crash the American economy

An unrealized earning tax is an Orwellian concept and it serves as the ultimate government power grab.

This week, the Kamala Harris campaign unsurprisingly endorsed the Biden-Harris administration’s fiscal year 2025 budget, which stands to increase taxes by at least $5 trillion over the next decade.

The most controversial idea within the hyper-progressive shakedown plan is an annual 25 percent *minimum* tax on “unrealized gains” of individuals with income and assets that exceed $100 million, according to Americans For Tax Reform.

Please check out our amazing, curated sponsors, which are specifically tailored for our readership. It goes a long way to supporting The Dossier.

Don’t forget to stay hydrated!

Don't let the summer heat drain your natural energy. Stay cool, hydrated, and vibrant with NativePath Hydrate - a powerful powdered electrolyte drink mixdesigned to keep you hydrated as nature intended.

It tastes WAY better than the big brands, and it’s much healthier too.

Stock up now and enjoy up to 44% off your purchase, plus receive free shipping (and a free tumbler!) with every order. Give it a try.

As with all new taxes, that number will almost certainly come down to envelop much of society.

America’s original federal income tax only applied to less than one percent of all households. It now applies to almost three-quarters of the country.

But even if we put aside the inevitable, an unrealized gains tax on America’s wealthiest citizens would result in absolute disaster.

An unrealized gain is a positive change in the value of a stock, bond, or any asset of value that you have purchased but not yet sold. This would potentially apply to assets like your home, any collectors items, your gold stash, your bitcoin holdings, the stocks in your brokerage account, and many other equities.

Even if you believe that a Harris Administration would only tax the “super rich,” the cascading effects of forcing all these people to sell off their "unrealized" assets will crash the economy, destroy innovation, and lead those targeted by the government to flee the country.

There are roughly 10,000 Americans whose wealth crosses over that $100 million threshold. And here’s how this tax would “trickle down” to lower tax brackets:

Say you’re Elon Musk or Larry Ellison, who both happen to be GOP voters, who are less likely to find a magic Democrat carve out or loophole to avoid the pain of an unrealized gains tax.

Musk owns over 20% of Tesla’s shares outstanding. Ellison owns 42% of Oracle’s outstanding stock. Should these men be hit with a 25% annual tax on their unrealized gains, they could be forced to dump tens of billions of dollars onto the market on a yearly basis.

An annual large sale of shares of this magnitude would cause all retail investor boats to sink, and for Tesla and Oracle investors to witness a sharp decline in the value of their holdings.

The sell-off caused by the government initiative would harm the respective companies’ overall market value, cutting into their profit margins and threatening the jobs of the 140,000 Tesla employees and 160,000 Oracle employees. Surely, it would force company leadership to consider relocating to a different country with a more hospitable business environment, which would further jeopardize American jobs.

More broadly, the annual sell-off would also destroy investor confidence in the value of U.S. “free” markets, leaving Americans with few tools to fend off the inflation behemoth that government policy caused.

Sure, an unrealized gains tax may only impact 10,000 people (at first), but that alone is enough to crash the U.S. economy and harm all Americans.

An unrealized earning tax is an Orwellian concept and it serves as the ultimate government power grab. It would involve selectively raiding the possessions of the White House’s political opponents. Allies of the political establishment would surely get a carve-out, while perceived enemies would get shaken down.

The Supreme Court is currently reviewing the constitutionality of such a concept. Let’s hope they strike it down and take a potential instrument to detonate the American economy out of the hands of Kamala Harris and her allies in Congress.

We already get taxed on unrealized gains with property taxes. My home is paid off and I have no plans to EVER sell it. This year, our "market appraisal" rose over 200%. I guarantee you my home did not gain 200% more "market value" from last and I'd never be able to sell it for this ridiculous price. The entire county is up in arms. Pleading to our state legislators falls on deaf ears. The grapevine says the feds are looking hard at a 3% property tax in the near future. Not sure how that would work, but it's just another way to tax people out of home ownership.

The whole idea of "investing" is hoping you make a good choice and you make money instead of losing it. As with most, if not all investments, it could go either way, and it changes all the time, up and down. It is YOUR money on the line, and the risk is all yours. You might gain, or you might lose. You won't know until you sell your investment. And you don't get money from your investment until you sell it. So why would anyone think its OK to pay taxes on money you haven't really gotten and you don't even know if you will really ever get? What a great way to discourage investment! They should be doing the opposite. And what happens when you lose money after paying taxes on the fake profit? Do they give you back all those taxes with interest? Yeah, right! "Creative taxes" are just scams to take more money away from the citizens and pretend it isn't hurting anyone.